Business Tax Services

Trusted business tax preparation and planning to minimize your tax liability and maximize deductions. We understand the complexities of business taxation and work to optimize your tax position.

- Corporate, partnership, and LLC tax returns

- Strategic business tax planning

- Sales tax and compliance services

- IRS representation and audit support

Get Started Today

Schedule a free consultation to discuss your needs

We'll respond within 1 business day

Our Business Tax Services

Comprehensive tax solutions for businesses of all sizes and structures

Corporate Tax Returns

Comprehensive tax return preparation for C-Corps, S-Corps, partnerships, and LLCs ensuring compliance and tax optimization.

Tax-Return Ready Financial Statements

Month-end and year-end tax-return ready financial statements prepared specifically to support your tax return preparation.

Business Tax Planning

Strategic tax planning to minimize your business tax liability through entity structuring, timing strategies, and tax-advantaged investments.

Multi-State Business Tax

Trusted handling of complex multi-state tax compliance for businesses operating across multiple jurisdictions.

Sales & Use Tax Returns

Preparation and filing of sales and use tax returns for Louisiana and other jurisdictions where your business operates.

IRS Business Representation

Professional representation for business audits, notices, and disputes with tax authorities.

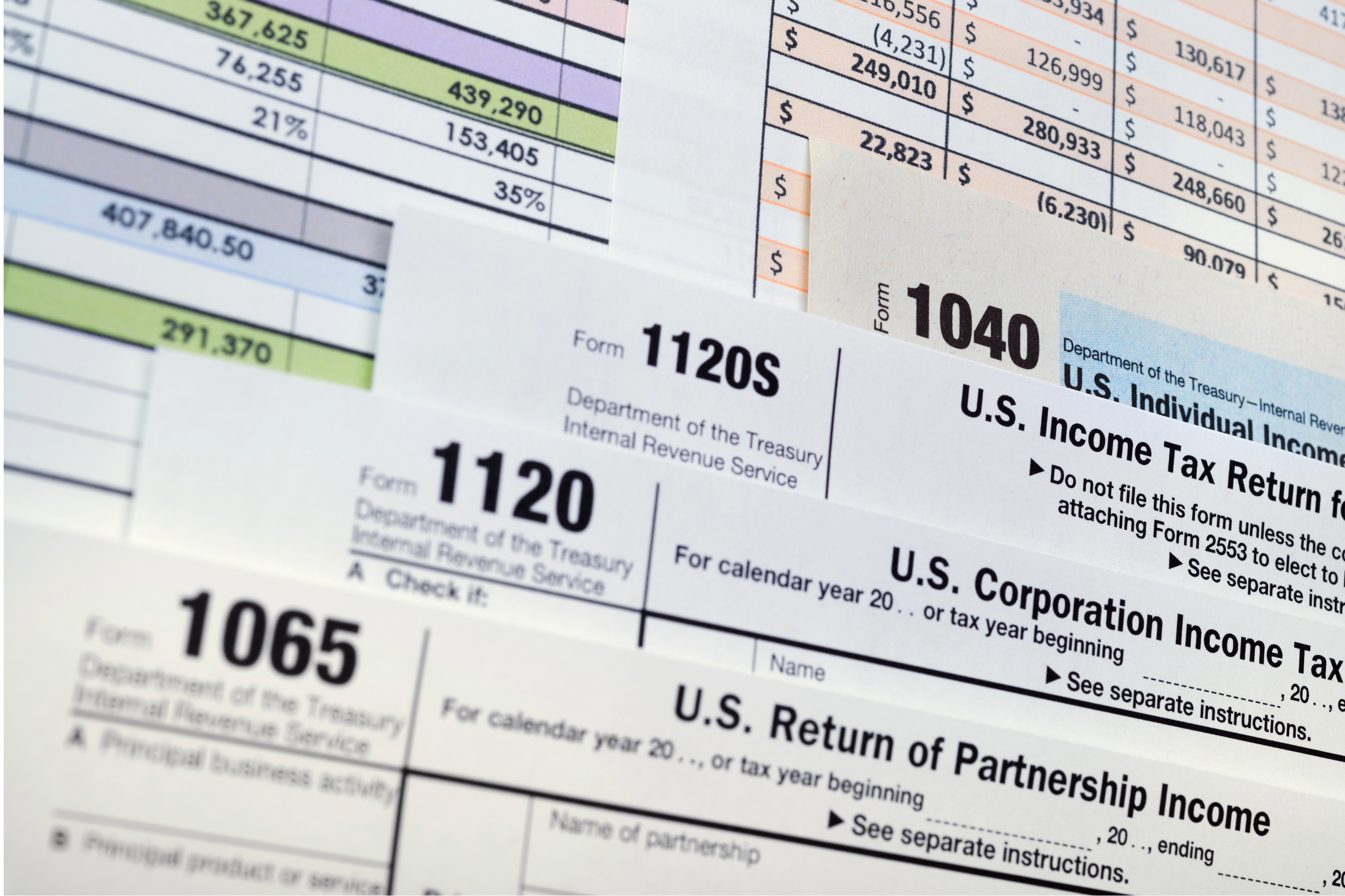

We Serve All Business Entity Types

From startups to established enterprises, we handle tax preparation for all business structures

- S-Corporations (1120-S)

- C-Corporations (1120)

- Partnerships (1065)

- Multi-Member LLCs

- Single-Member LLCs

- Sole Proprietorships (Schedule C)

- Non-Profit Organizations (990)

- Trust and Estate Returns

Why Choose Professional Business Tax Services?

The advantages of working with experienced business tax professionals

Maximize Deductions

Our CPAs identify every eligible business deduction and credit to minimize your tax liability.

Stay Compliant

Ensure your business meets all federal, state, and local tax requirements to avoid penalties.

Strategic Planning

Year-round tax planning to make informed decisions that optimize your tax position.

Trusted Guidance

Access to experienced CPAs who understand your industry and can provide tailored advice.

Frequently Asked Questions

What business tax returns do you prepare?

We prepare all types of business tax returns including C-Corp (1120), S-Corp (1120-S), Partnership (1065), and LLC returns. We also handle Schedule C for sole proprietors and Form 990 for non-profits.

When are business tax returns due?

Most business returns are due March 15th (S-Corps and Partnerships) or April 15th (C-Corps and LLCs taxed as sole proprietorships). We recommend starting early to ensure timely filing.

Do you provide year-round tax planning?

Yes! We offer ongoing tax planning services to help you make strategic decisions throughout the year that minimize your tax liability and maximize profitability.

Can you help with sales tax compliance?

Absolutely. We handle sales and use tax return preparation, filing, and compliance for Louisiana and other states where your business operates.

Ready to Minimize Your Business Taxes?

Schedule your business tax consultation today and let our experienced CPAs optimize your tax position

.png)